The Ledger accounts are a summary of all books of prime entry and journals. The ledger account is a very useful tool for recording accounting transactions in summarized form. The system of summarizing accounting transactions is very useful for every stakeholder of business. For instance, if a sales manager wants to analyze sales of last month, he can see at a glance from the sales ledger.

The account payable department monitors the payable balances. The ledger will provide valuable information to the payable department by summarizing all the purchases made on credit. This will allow the purchase manager to control purchases on credit.

All information of books of prime entry carries forward to nominal ledgers. Accounting software also operates in the same way and every account has an account code. For example, the salary ledger has a different code from the wage ledger. Key accounts are always restricted due to the risk of fraud.

Examples of nominal accounts are as follows:

- Account Payable

- Account Receivable

- Inventory

- Cash in hand

- Property, Plant, and equipment

- Electricity Bills

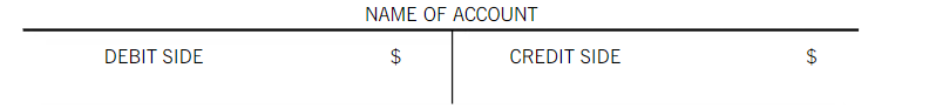

The ledger accounts are also called T accounts. There are two sides to the T accounts, one debit side while the other is credit side.

All the closing balances in the ledgers are transferred to the trial balance. You can not prepare the trial balance without ledger accounts.